What is the Syndicate Bank Account Opening Form

The Syndicate Bank Account Opening Form is the necessary documentation required to establish a banking relationship with the Syndicate Bank. You can open an individual, joint, or minor savings account or current accounts for firms to access various products and channels offered by the bank.

Information Required on the Syndicate Bank Account Opening Form

For the bank to accept your application for an account, you must furnish them with the following details:

- Personal details such as name, guardian name, or firm name depending on the type of account.

- Obligations with other banks in the form of accounts or credit facilities.

- Operating instructions for joint accounts if applicable.

- Operating instructions for proprietorship accounts.

- Authorization for 'sweep out, sweep in' facility.

- Nominee details.

- Application for channel registration.

How to Fill out the Syndicate Bank Account Opening Form

The Syndicate Bank Account Opening Form avails critical financial facilities such as unique products and channels offered by the bank. To enable you to fill it with ease, the following is a simple step-by-step procedure:

Step 1: Enter Reference Details

Start by indicating the particular branch of the bank where you wish to open an account. Provide the date, current residence, and your initial deposit amount as provided below.

Step 2: Enter Your Personal Details

Enter your name if you are the applicant, applicants for a joint account, guardians if the applicant is a minor, and firm name and constitution for the current account. Provide your address, including phone numbers, email, and PIN CODE. Remember to enclose your information form with a photograph and signature.

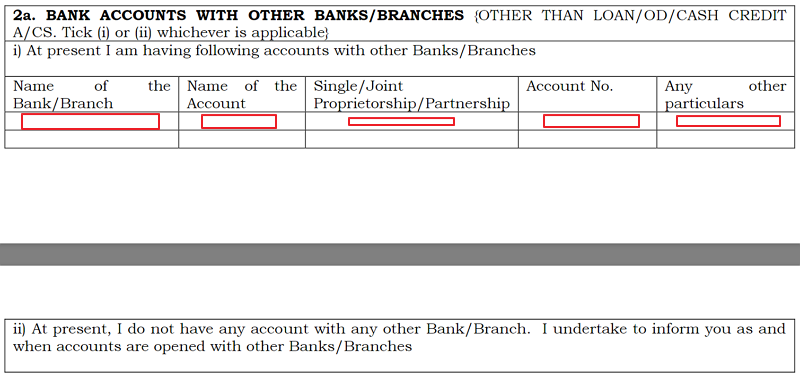

Step 3: State Your Obligations with other Banks

If you have an account with another bank, give the name and branch of the bank, account name, and state the nature of its ownership. Provide the account number and other particulars as well. If you don't have a bank account with another bank, indicate so.

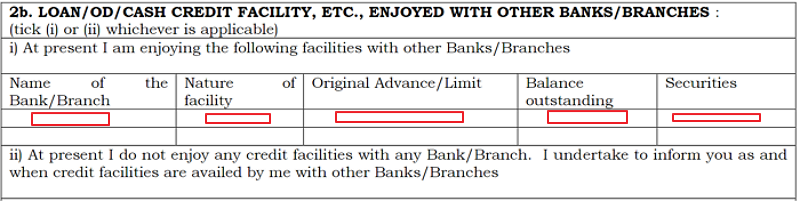

Fill part b of this step to indicate the name and branch of the bank that has advanced you a credit facility. State the nature of the facility, the original advance, outstanding balance, and securities attached to it. If you don't have a credit facility, indicate so in the provided space below.

Step 4: Enter Operating Instructions for Joint and Current Accounts

Tick appropriately to indicate how applicants will operate the account. Enter formal request and authorization on how the bank will handle your cheques, orders drawn, accepted bills of exchange, and notes.

Step 5: Details On Proprietorship and Minor's Accounts

If you are applying for a proprietorship or a minor's account, provide your name, signature, and date where applicable for recordkeeping and reference by the bank. You also have to state your relationship with the minor, as shown below.

Step 6: Authorize 'Sweep out, sweep in'

Enter the maximum and minimum amount you want your savings account to hold and the amount to be deposited in case of any inadequacy.

Step 7: Provide a Nominee

Enter your name, the nature of the account, and the account number. Enter their name, relationship with you, age, and date of birth in case of a minor to nominate a person. If the nominee is a minor at your demise, appoint another person to receive the balance on their behalf and then append your signature. You may as well avoid nomination by ticking the box at the bottom left corner.

Step 8: Apply for Channel Registration

Check your preferred channel and provide your name, email, and unique personal identification particulars.

What is the Syndicate Bank Account Opening Form Used For

As its name suggests, the form's purpose is to facilitate opening an account with Syndicate Bank. You have to complete the form and ensure all details are accurate and correct to be eligible for an account with the bank. The Syndicate bank is a cheaper and safer way of storing your money as the government regulates it. It offers customers a convenient way for transactions in cash and a required step in accessing credit.

Who Needs the Syndicate Bank Account Opening Form

Individuals who jointly or individually want to open an account with the Syndicate Bank for safekeeping their money need the Syndicate Bank Account Opening Form. Businesses, firms, and sole proprietors intending to present a professional outlook, simplify tax preparation and receive electronic payment need the form to open an account. What’s more, guardians wishing to secure their dependent's future and teach them a savings culture also need the form.

Additional Syndicate Bank Account Opening Form Resources

Below are some additional resources to help you understand this form and details to include when applying to open an account: